The Buncombe County Board of Commissioners is continuing its work creating a 2026 fiscal year budget as they address nuanced difficulties stemming from Hurricane Helene. The FY26 budget runs from July 1, 2025-June 30, 2026. On April 22, the Board of Commissioners held a budget retreat to discuss education spending, year-end financial projections, and more. This is the second budget work session of the year with Commissioners slated to hold a public hearing on the spending plan during their meeting on May 20 with adoption of the budget set for June 3.

FY25 year-end projections

One of the challenges in the post-Helene landscape is the significant loss of property tax base due to more than 9,000 damaged buildings. As of January 2025, the County’s property tax collection rate is at 95.82%, which is down for 2024’s rate of 96.1%. The County’s revenue projections for FY25 show shortfalls compared to budget in the following areas:

- Property tax: -$5.2 million

- Intergovernmental fees: -$0.4 million

- Local option sales tax: -$2.2 million

- Sales and services: -$0.9 million

- Other revenues: -$4.4 million

In all, the County is looking at a $13.1 million revenue shortfall based on County revenue projections conducted in April 2025.

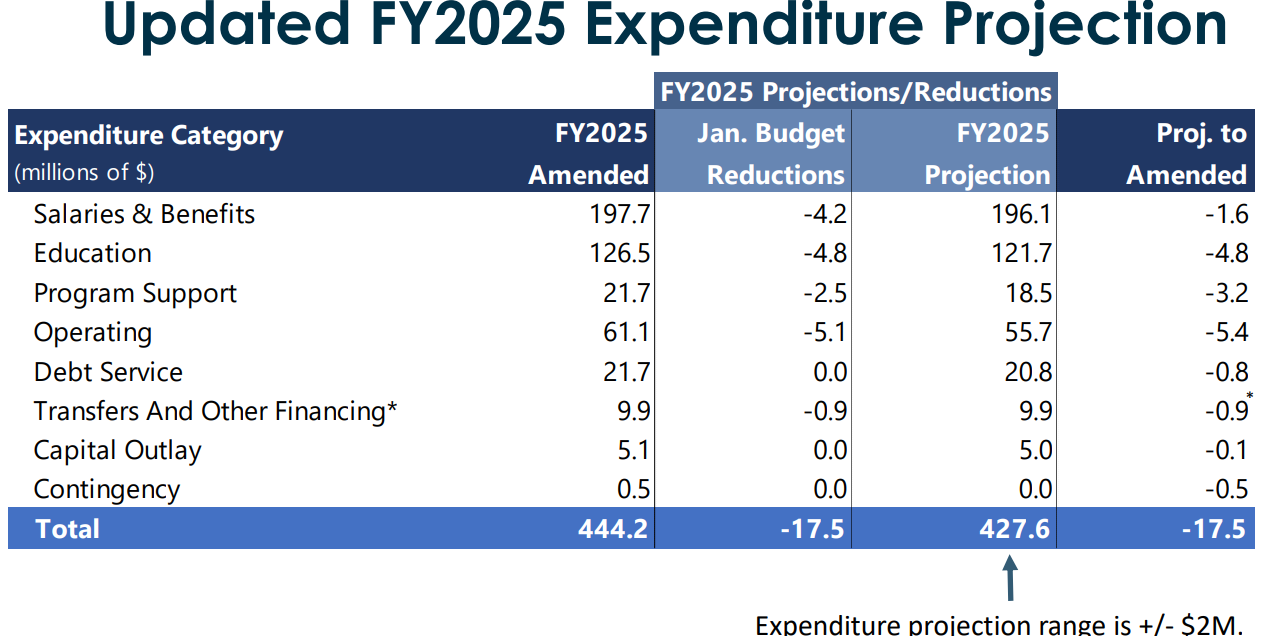

Regarding expenditure projections, the County is looking at underspending by $17.5 million according to FY25 projections stemming from costs related to education, debt services, operating costs, and other factors. You can see a breakdown of those projections below:

This projection estimates a use of fund balance of around $11.3 million, plus or minus $2.5 million, leaving 12.9% to 14.7% of available fund balance remaining.

Helene expenditures

According to the latest data available, Buncombe County has spent $19.8 million on Helene-related costs, has committed an additional $8.1 million for future projects, and overall estimates that all recovery costs will be $52 million. Some of this funding could be covered by grant or other external revenues and County staff continues to identify and apply for various outside sources of money.

The Helene cost recovery breakdown is as follows.

Expenditure reimbursements potentially at risk:

- Helene Resource Center: $600,000

- Disaster recovery consultant: $936,000

- Community navigators: $486,000

- Recovery support coordination: $145,000

- Program management: $76,000

- Emergency watershed protection: $229,000

Fiscal considerations:

- Average FEMA reimbursement timeline is three to six years.

- Available fund balance covers Helene costs until reimbursed:

- Every reduction of $4.5 million in cost draws down the fund balance by 1%.

- The current cost of $19.8 million will have about a 4% reduction in the available fund balance.

Personnel

As a service-driven organization, Buncombe County’s staff is key to providing mandated and peripheral services. Demand for these services continues to increase in many crucial areas such as 911 calls, emergency medical services, Medicaid cases, food and lodging permits, property assessments, flood permits, and more. The proposed budget does not include any new positions, but funds all current positions for the new fiscal year.

Personnel-driven costs for the proposed FY26 budget include:

- $1.1 million for increased retirement costs mandated by North Carolina. Retirement rate is estimated to increase from 13.63% to 14.35%; for Law Enforcement: 15.04% to 15.94%.

- $1.5 million for increase of health insurance. This figure represents increases in health insurance results from expected claims and insurance administration costs, not any plan or benefit changes.

- $1.9 million for non-discretionary and other post-employment benefits.

- $4.8 million for employee cost-of-living adjustment (COLA) of 3.09%

Capital projects, vehicles, IT

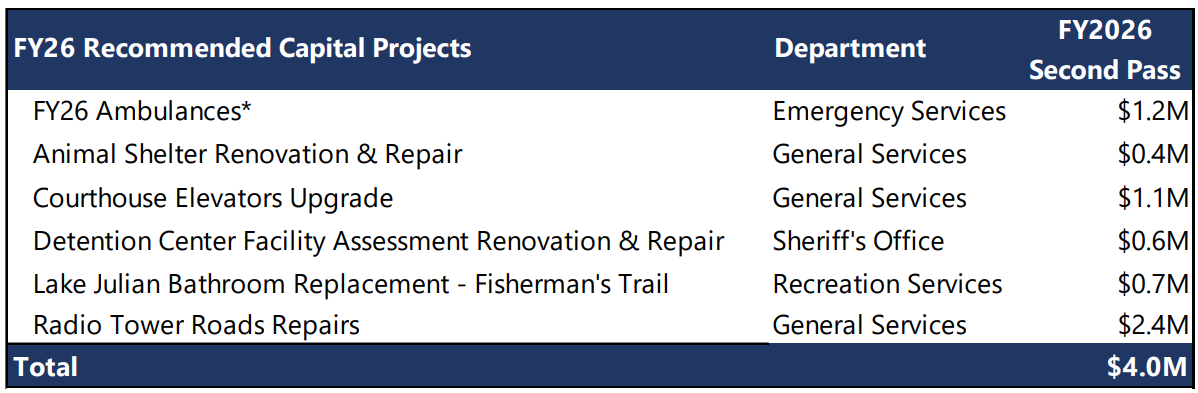

County staff recommend the following capital improvement plan debt projects totaling $4 million.

The FY26 budget also calls for 10 vehicle purchases and three vehicle leases for various departments at a total of $627,000. The following are recommended for inclusion in the budget. Also, the below vehicles are separate from the replacement vehicles needed for those damaged during Helene, which are being submitted for insurance proceeds or federal reimbursement.

- $588,000 to purchase 10 SUVs with upfits for the Sheriff’s Office

- $26,000 to lease two hybrid replacement trucks for Permits & Inspection

- $13,000 to lease one electric replacement truck for Solid Waste

Additionally, the following information technology-based projects totaling $61,000 are recommended for the FY26 budget.

- $8,000 for the Sheriff's Office court enforcement turnstile relocation

- $16,000 for the Sheriff's Office courthouse cameras

- $22,000 for the Sheriff's Office detention cameras and monitors

- $3,000 for Emergency Services warehouse cellular and radio coverage

- $12,000 for Emergency Services EMS inventory management

Charges and fees

Buncombe County is looking to stop absorbing credit card transaction fees. These fees total more than $370,000 in annual aggregate fees by charging any applicable convenience fees on credit or debit card transactions. Solid Waste is also requesting an increase for tipping (disposal) fees, which is the department’s primary revenue source. The budget would include the following tipping fee increases:

- Increase from $45 to $50 per ton at the landfill

- Increase from $52 to $60 per ton at the transfer station

Parks and Recreation is also looking to implement fees for river usage, mostly for commercial outfitters.

Fees for nonprofit, for-profit, or private businesses using Buncombe County Parks for commercial uses.

- Will charge in two tiers – Class 1 (nonprofit) and Class 2 (for-profit)

- Includes:

- Commercial Use Application Fee ($25 for Class 1 and $50 for Class 2)

- Commercial Use Fee ($1/user for Class 1 and $2/user for Class 2)

Education spending

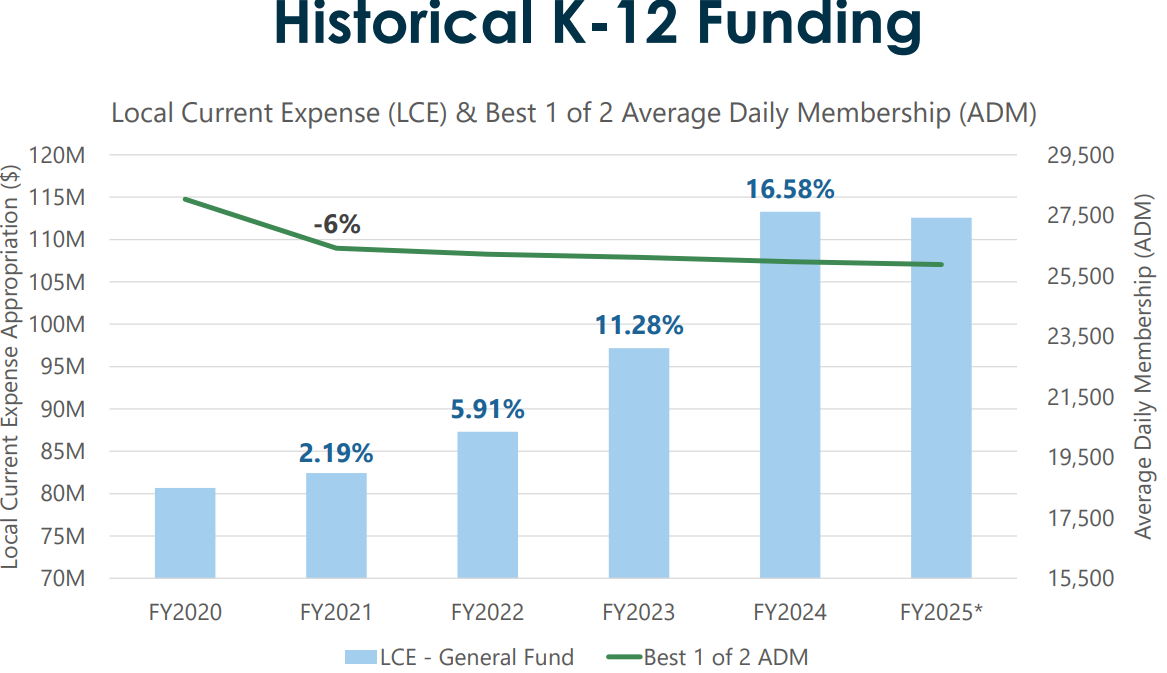

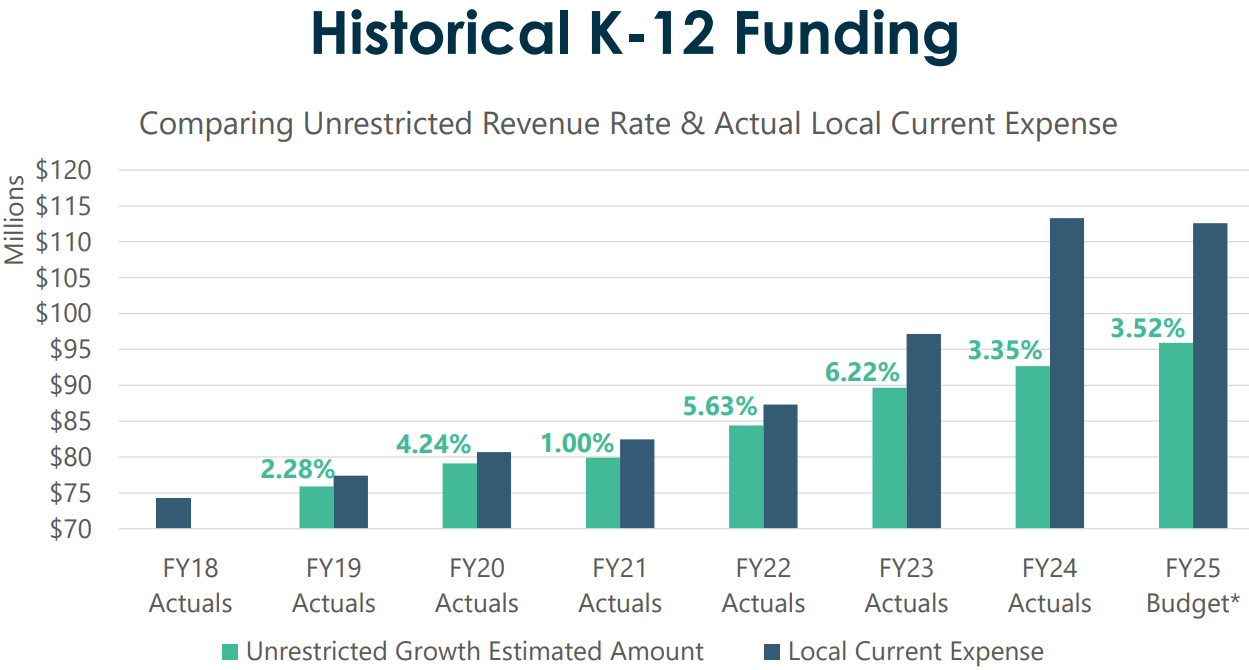

Education makes up the largest expenditure for the County’s budget. The state is mandated to cover instructional expenses while counties in North Carolina are required to pay for facility requirements. Local government can cover additional operating expenses and teacher salary supplements. In the past, the County has funded education above mandated levels and committed to helping increase teacher salaries based on school system studies and recommendations.

Last year, Commissioners approved a 1.96-cent tax increase with .75 cents being dedicated to help increase teacher salary supplements and other education needs. Below you can see charts showing Buncombe County’s commitment to K-12 education for both Asheville City and Buncombe County school systems.

*Original Budget for FY2025 was $117M prior to Hurricane Helene related reductions.

*Original Budget for FY2025 was $117M prior to Hurricane Helene related reductions.

During an upcoming budget work session set for May 2, Commissioners will hear presentations and discuss education funding with representatives from Asheville City and Buncombe County school systems as well as AB Tech.

FY26 expenditures

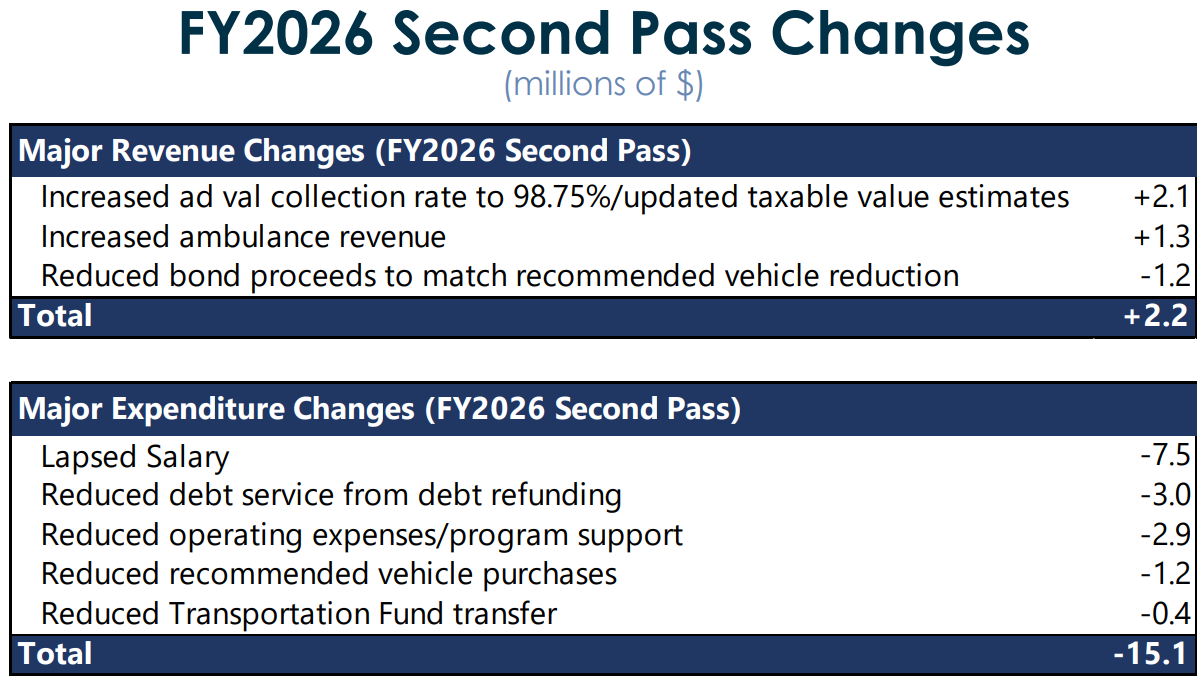

As the FY26 budget continues to come into focus, Commissioners and staff have made adjustments to the proposed expenditures and received updated projections for revenues. To help save money, the County is not adding any new positions, is recommending reduced vehicle purchases, and more. Below you can see some of the updated revenue and expenditure changes for FY26.

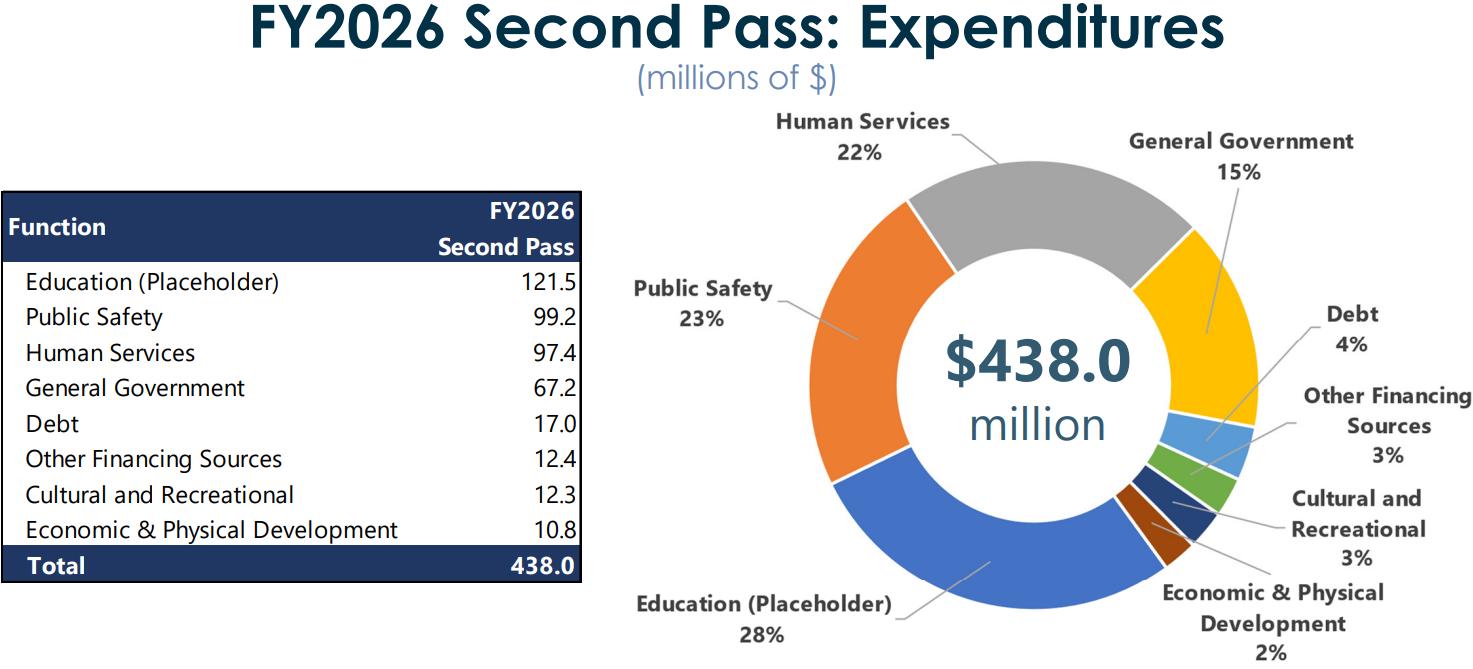

The three largest expenditures for Buncombe County include education, public safety, and human services. The proposed budget has $438 million in projected expenditures with projected revenues at $415.5 million, which creates a potential gap of $22.5 million. You can see a breakdown of proposed spending in the FY26 budget below.

Balancing strategies

County staff recommends the following strategies for helping balance the budget.

- Personnel strategies

- No new staff for FY26

- Budgeting for 96.5% of salaries with anticipated turnover creates a projected $7.5 million in savings

- Deferring capital

- All recommended capital projects are slated to be funded by debt or outside funding sources (i.e., federal funding).

- No FY26 debt service costs from FY26 capital projects or vehicles.

- Expenditure reductions

- General Operating/Program Support Reductions: The total operating and program support (not including education) has been reduced by $2.8 million since the budget’s first draft and is recommended at $5.4M below FY25 amended budget.

- Education: Return to FY25 adopted less unrestricted revenue rate resulting in a total reduction of $4.1 million.

- Discretionary community investments: These represent $10.3 million and could be paused or see strategically targeted reductions.

- Increasing revenue

- Increasing property tax. A 1-cent increase is projected to create $5.23 million (based on a 98.75% collection rate).

No budget or tax decisions were finalized during the April 22 budget work session. Commissioners directed staff to look at pausing some community investments and initiatives while continuing to work with outside partners to identify additional savings as the budget continues to evolve ahead of its adoption in June.

Next Steps

The following are the upcoming meetings associated with continued crafting and approval of the FY26 budget.

- May 2: Education and fire districts

- May 6: Manager’s recommended budget

- May 20: Public hearing on recommended budget

- June 3: Budget adoption

You can read a recap of all budget-based meetings on our website and watch those meetings live on our Facebook page.